For a free trial, send an email to hdvortex@yahoo.com. Will need your name and Machine ID to set you up for a free trial. The name is just to separate you from others requesting a free trial and can be your name or whatever handle you prefer. If you send an email, but do not hear back within a few days, send another email, as sometimes emails get lost or end up in the spam folder, or call US telephone number 1-617-458-0111, since you should always hear back within a day or two. Also, feel free to join my Discord for commentary on hundreds of charts of different time periods.

If you’ve already been set up for a free trial, click here to transfer to the download page ===> Download

How to get the most out of a free trial:

Set up two charts next to each other, as depicted on the Home page. Choose two time periods which go well with each other. Obviously, monthly and 1-minute are a far cry from a good pair. I like the following:

Weekly/Daily

240-minute/30-minute

30-minute/5-minute

10-minute/2-minute

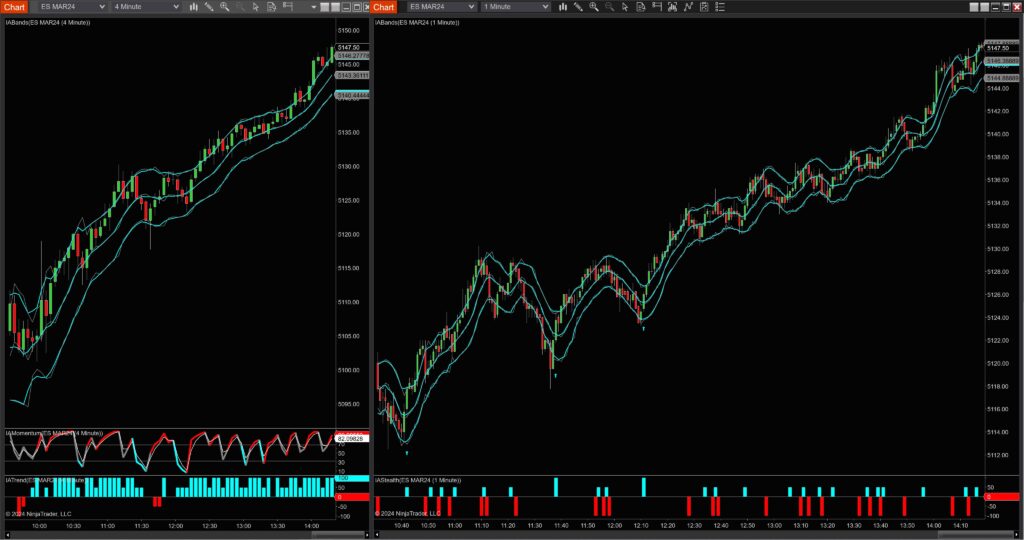

4-minute/1-minute

2-minute/1-minute

You can certainly experiment with other time periods, but the six listed above are what I like.

There’s a long write-up in my free Discord detailing six months of trades with pics. Request to join and I will make sure you will be able to check them all out. I’ve given trades and commentary every single trading day from September 22, 2023 through February 1, 2024 for the 30-year Treasury bond futures, along with trades and commentary on other futures, stocks, and exchange-traded funds.

On a 240-minute/30-minute position, I recommend taking off half of any profit at a 240-minute band and holding the remainder for a bigger move, while being ready to exit the rest of the position above the original entry if the market reverses.

On a 30-minute/5-minute position, usually take any profits when price hits the opposite 30-minute band or end of day.

On a 4-minute/1-minute position, try to hold some of the position until end of day, as these opportunities usually occur during big moves such as during late range extensions and on trend days when the close will often be close to the high or low of the day.

On a 2-minute/1-minute position, try to hold some of the position until end of day, as these opportunities usually occur during big moves such as during late range extensions and on trend days when the close will often be close to the high or low of the day. On a very fast moving day, there will be many more opportunities with the 2-minute than with the 4-minute.

One thing about the 4-minute/1-minute and the 2-minute/1-minute is they can be used during the volatility which usually occurs after the market opens. It may turn out to be a trend day or it may not turn out to be a trend day, but for however long price moves in one direction, the 4-minute and the 2-minute will give potential reversal areas, bottoms in an uptrend and tops in a downtrend, same as it will on a trend day and same as it will on a late range extension day. No reason to wait to see if it will turn out to be a trend day, which we often decipher after the fact, and maybe face a failed trend day. Plenty of time to take action in the first half of the day.

Example below, which would have been profitable at the 4-minute/1-minute entries whether it later turned out to be a trend day or a failed trend day. When price seems to face a particular direction soon after the open, look for the 4-minute and 2-minute time frames to give signals. Again, after the open is when big moves often occur. As it turned out, the trend day behavior slowed down several hours before the Friday 5:00 pm NY time the E-mini futures close.

Below: 4-minute and 1-minute charts for the March 2024 S&P 500 E-mini futures contract

I‘ve been making discoveries in the markets since 1982, when I made my first trades on gold and silver futures. I’ve been able to come up with some great methods in the four decades plus since then.

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.